If you’ve been keeping up with the market and investment news you probably couldn’t help but notice all the commentary about the possible bond market bubble. See here for an example. The Siegel article in the WSJ is probably the most high profile piece on this topic yet.

The argument is basically that government bond yields are so low they have nowhere to go but up especially given all the government debt, all the printing of money, etc…and that bond investors are going to get slaughtered. And of course, much of the commentary discusses how stocks are so cheap in comparison to bonds.

All this discussion got me thinking about stock and bond risk and how it is measured. Most often risk is measured by how much the price of an asset varies over time, or in other words, its volatility. The mathematical expression used to quantify the amount of this movement, or volatility, is called standard deviation. For example, from 1973-2008 (the time period I could quickly find data for) the standard deviation of the S&P500 was 15.54% and for a 10yr bond index it was 9.06%. During this time period stocks were almost twice as risky as bonds based on this measure. And thus this is why you should own bonds over stocks particularly for short time periods or for money you will need within 10 years. Or so the standard advice goes.

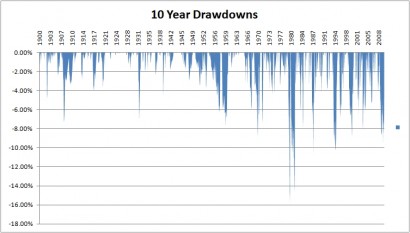

This is all good but one of the problems with using standard deviation as a measure of risk is that it includes both movements to the upside and downside. I think we all could agree its the downside movement that is the most concerning. This is especially true for retirees who don’t have as long as investment horizons to wait for investment returns to get them back to even. I think there is a better way to measure risk, in this case, risk of capital loss, of any asset class. Since we are worried primarily about capital loss we can measure the maximum peak to trough loss for an asset class. This metric is popular when evaluating hedge funds and its called maximum drawdown. Here is the historical maximum drawdown data for the S&P500 stocks and for 10yr bonds:

Both of these charts are from Mebane Faber and his fantastic blog World Beta. I highly recommend his site and book (which I’ll comment more in the future on).

For stocks it is possible to suffer an over 80% loss from peak to trough as happened during the great depression and there are several more drawdowns of 40%+ in this history. While for 10 yr bonds the max drawdown, or max capital loss, has been only just over 14% even in the inflation ravaged late 70s and early 80s. Stocks are riskier than you think over short periods of time. This is yet another reason I favor dividend stocks- all this volatility actually enhances the returns of dividend stocks (more in a later post).

With all the volatility in stocks in the last 3 years, yet another massive drawdown of ~50%, and lower inflation expectations, is it any wonder investors have clamored for bonds. Return OF capital comes way before return ON capital! All this talk of a bond bubble, the bursting (caused by rising interest rates) of which will cause what? Another max drawdown of 14% or so? Please…Much of this hyperbole is driven by Wall Street’s shorter and shorter time horizon. All the talk is of next year’s returns and what to buy this week or next and not long term returns – much to the detriment of the search for consistent long term compounded returns.

And another thing. Who says rising rates are a bad thing? It depends on your perspective. Yes, if bond rates rise you can suffer a capital loss as we’ve seen. But when rates rise those bond coupons you re-invest are being re-invested at a higher rate, i.e. your income stream goes up! Pimco put together a nice chart of this recently. I don’t have the link to it but here is the graphic.

After 5 years a rise in interest rates of 1% is better than a drop in interest rates of 1%. Where do you hear that? The conventional wisdom is often very misleading. This kind of effect can be critical for retiree portfolios where the income stream is so important.

In summary, I think the bond market bubble talk is a bunch of hype. Maybe they are in a bubble, maybe not. But if they are in a bubble the results of its demise will be mild and will actually have some benefits. For me, the real risk of bonds is not providing adequate returns to keep up with inflation and taxes over long periods of time, a risk that is rarely talked about.

2 Comments

Inflation « Investing For A Living · September 29, 2010 at 1:29 am

[…] Filed under: Uncategorized — libertatemamo @ 1:29 am Yesterday’s post got me thinking about inflation. As I said yesterday, “For me, the real risk of bonds is not […]

Death by Bonds II « Investing For A Living · April 11, 2011 at 2:14 pm

[…] relatively assured of capital preservation. I posted on the drawdowns of stocks and bonds in this post and showed that historically stocks have much higher drawdowns than bonds. I said the the bond […]

Comments are closed.